Inventory cost flow assumptions address accounting issues when – Inventory cost flow assumptions play a crucial role in accounting, addressing key issues related to the recognition of expenses and revenues, valuation of inventory, and the impact of obsolescence and price fluctuations. This comprehensive analysis explores the various types of inventory cost flow assumptions, their advantages and disadvantages, and the factors to consider when selecting the most appropriate assumption for a specific business.

Inventory Cost Flow Assumptions: Overview: Inventory Cost Flow Assumptions Address Accounting Issues When

Inventory cost flow assumptions are accounting principles that determine how the cost of inventory is assigned to goods sold and ending inventory. These assumptions are necessary because the physical flow of inventory does not always match the order in which costs are incurred.

The three most common inventory cost flow assumptions are:

- First-in, first-out (FIFO)

- Last-in, first-out (LIFO)

- Weighted average cost

Accounting Issues Addressed by Inventory Cost Flow Assumptions

Inventory cost flow assumptions have a significant impact on the financial statements. They can affect the recognition of expenses and revenues, the valuation of inventory, and the calculation of cost of goods sold.

Recognition of Expenses and Revenues

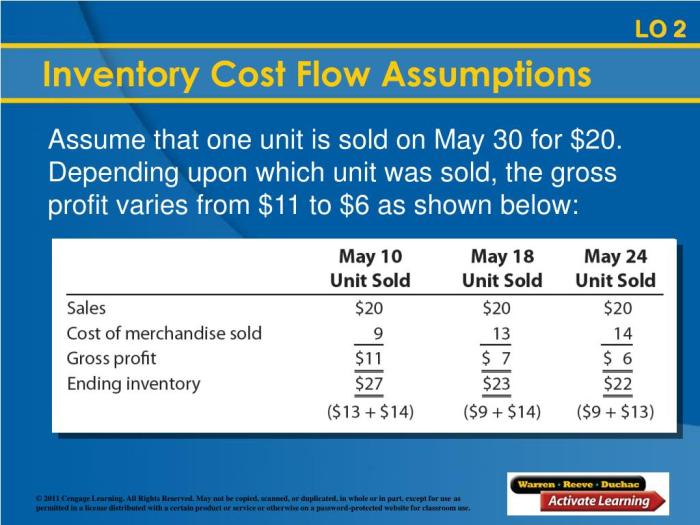

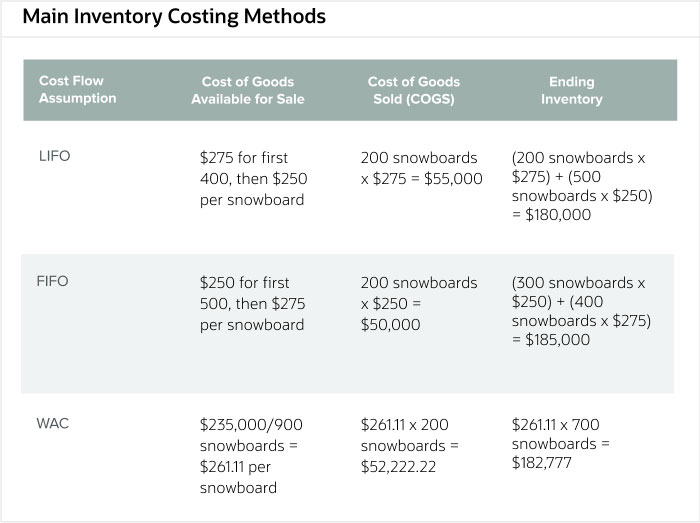

Inventory cost flow assumptions can affect the recognition of expenses and revenues by determining the cost of goods sold. For example, if a company uses FIFO, the cost of goods sold will be based on the cost of the oldest inventory.

This can result in higher cost of goods sold and lower net income in periods of rising prices.

Valuation of Inventory, Inventory cost flow assumptions address accounting issues when

Inventory cost flow assumptions can also affect the valuation of inventory. For example, if a company uses LIFO, the ending inventory will be valued at the cost of the most recent purchases. This can result in lower inventory values and higher cost of goods sold in periods of rising prices.

Calculation of Cost of Goods Sold

Inventory cost flow assumptions can also affect the calculation of cost of goods sold. For example, if a company uses weighted average cost, the cost of goods sold will be based on the average cost of all inventory on hand.

This can result in a more stable cost of goods sold and net income in periods of fluctuating prices.

Specific Accounting Issues Addressed

In addition to the general accounting issues addressed above, inventory cost flow assumptions can also address specific accounting issues, such as obsolescence and price fluctuations.

Obsolescence

Obsolescence is the risk that inventory will become obsolete and unsalable. Inventory cost flow assumptions can be used to mitigate the risk of obsolescence by allowing companies to write down the value of obsolete inventory.

Price Fluctuations

Price fluctuations can also affect the value of inventory. Inventory cost flow assumptions can be used to mitigate the impact of price fluctuations by allowing companies to adjust the cost of inventory to reflect current market prices.

Considerations for Choosing an Inventory Cost Flow Assumption

When choosing an inventory cost flow assumption, companies should consider a number of factors, including:

- The nature of the business

- The volatility of inventory costs

- The tax implications of the different inventory cost flow assumptions

The most appropriate inventory cost flow assumption for a particular company will depend on the specific circumstances of the business.

International Accounting Standards and Inventory Cost Flow Assumptions

International Accounting Standards (IAS) are a set of accounting standards that are used in over 140 countries. IAS 2, Inventories, provides guidance on the use of inventory cost flow assumptions.

IAS 2 allows companies to use any of the three most common inventory cost flow assumptions: FIFO, LIFO, and weighted average cost. However, IAS 2 does not allow companies to change their inventory cost flow assumption from one period to the next.

Quick FAQs

What is the purpose of inventory cost flow assumptions?

Inventory cost flow assumptions provide a basis for assigning costs to inventory items as they are sold or used. They help determine the cost of goods sold and the ending inventory value, which impact financial statements.

How do inventory cost flow assumptions affect the valuation of inventory?

Different inventory cost flow assumptions result in different inventory valuations. For example, FIFO (first-in, first-out) assumes that the oldest inventory is sold first, leading to a higher ending inventory value and lower cost of goods sold in inflationary periods.

What factors should be considered when choosing an inventory cost flow assumption?

Factors to consider include the nature of the business, the inventory characteristics (perishability, obsolescence risk), tax implications, and the desired financial reporting outcomes.