Macro topic 5.2 the phillips curve – Delving into macro topic 5.2, the Phillips curve, we embark on a journey to unravel the intricate connection between inflation and unemployment. This concept has profoundly shaped economic policy and sparked ongoing debates.

The Phillips curve posits an inverse relationship between these two economic indicators. As inflation rises, unemployment tends to fall, and vice versa. This relationship has significant implications for policymakers, who must navigate the delicate balance between controlling inflation and maintaining low unemployment rates.

Economic Significance of the Phillips Curve

The Phillips curve illustrates the inverse relationship between inflation and unemployment. During periods of low unemployment, businesses compete for a limited labor supply, leading to higher wages and consequently increased production costs. This inflationary pressure manifests as a rise in the overall price level.

Conversely, when unemployment is high, labor is more readily available, resulting in lower wages and reduced production costs, contributing to lower inflation.

Implications for Economic Policy

The Phillips curve has significant implications for economic policymakers. By understanding the trade-off between inflation and unemployment, policymakers can tailor monetary and fiscal policies to achieve desired economic outcomes. For instance, if policymakers prioritize reducing unemployment, they may adopt expansionary policies that stimulate economic growth and job creation, potentially leading to higher inflation.

Conversely, if policymakers aim to curb inflation, they may implement contractionary policies that slow economic growth and reduce job creation, potentially leading to higher unemployment.

Assumptions of the Phillips Curve

The Phillips curve assumes a stable and predictable relationship between inflation and unemployment. It is based on the following assumptions:

- Wage rigidity:Wages are slow to adjust to changes in the labor market, creating a trade-off between inflation and unemployment.

- Homogenous labor market:All workers are considered interchangeable, with similar skills and expectations.

- Absence of expectations:Workers and firms do not anticipate future inflation or unemployment, and thus their behavior is not influenced by expectations.

- Stable supply of labor:The labor supply is not affected by changes in the inflation rate.

Limitations of the Assumptions

These assumptions are often unrealistic in practice, leading to limitations in the Phillips curve’s accuracy:

- Wage flexibility:In reality, wages can adjust relatively quickly, especially during periods of high inflation or labor shortages.

- Heterogeneous labor market:Workers have varying skills, experience, and expectations, which can affect wage adjustments.

- Expectations formation:Workers and firms often anticipate future inflation and unemployment, which can influence their behavior.

- Labor supply elasticity:The labor supply can be affected by changes in the inflation rate, especially in the long run.

Empirical Evidence for the Phillips Curve

Empirical evidence generally supports the Phillips curve, indicating an inverse relationship between inflation and unemployment. However, the strength and stability of this relationship have varied over time and across countries.

Examples of Supporting Evidence

- Historical Data:Time series data from many countries show periods of high inflation coinciding with low unemployment and vice versa.

- Cross-Country Comparisons:Studies comparing countries with different levels of inflation and unemployment often find a negative correlation between the two variables.

- Econometric Analysis:Regression models using economic data often find a statistically significant inverse relationship between inflation and unemployment.

Challenges in Interpreting Empirical Evidence

- Short-Term vs. Long-Term:The Phillips curve may hold in the short term but break down in the long term due to structural changes in the economy.

- Data Limitations:Measuring inflation and unemployment accurately can be challenging, potentially affecting the reliability of empirical results.

- Policy Interventions:Government policies, such as minimum wage laws or unemployment benefits, can influence the relationship between inflation and unemployment.

Criticisms of the Phillips Curve: Macro Topic 5.2 The Phillips Curve

The Phillips curve has faced several criticisms, particularly in light of its breakdown in the 1970s.

Short-Run vs. Long-Run Trade-Off

One criticism is that the Phillips curve only represents a short-run trade-off between inflation and unemployment. In the long run, the curve is vertical, meaning that there is no permanent trade-off between the two variables. This is because in the long run, the economy will adjust to changes in inflation and unemployment, and the natural rate of unemployment will be reached.

Expectations and Adaptive Learning, Macro topic 5.2 the phillips curve

Another criticism is that the Phillips curve assumes that people’s expectations about inflation are fixed. However, in reality, people’s expectations can change, and this can affect the relationship between inflation and unemployment. For example, if people expect inflation to be high, they may be more willing to accept higher wages, which can lead to a higher rate of inflation.

Supply Shocks

The Phillips curve also assumes that the economy is not subject to supply shocks. However, supply shocks, such as oil price shocks or natural disasters, can cause a temporary increase in both inflation and unemployment. This can lead to a situation where the Phillips curve is not a good predictor of the relationship between inflation and unemployment.

Breakdown in the 1970s

The Phillips curve broke down in the 1970s, when the economy experienced both high inflation and high unemployment. This was due to a combination of factors, including the oil crisis, the Vietnam War, and the end of the Bretton Woods system.

The breakdown of the Phillips curve led to a reassessment of the relationship between inflation and unemployment, and the development of new economic models.

Alternatives to the Phillips Curve

The Phillips Curve is not the only model that attempts to explain the relationship between inflation and unemployment. Other alternative models have been proposed to address the shortcomings of the Phillips Curve and provide a more comprehensive understanding of this complex relationship.

The Natural Rate Hypothesis

The Natural Rate Hypothesis, proposed by Milton Friedman, suggests that there is a natural rate of unemployment that cannot be permanently reduced through expansionary monetary or fiscal policies. This natural rate is determined by structural factors in the labor market, such as the mismatch between job seekers and job openings, labor market regulations, and the level of technological advancement.

According to this hypothesis, attempts to reduce unemployment below the natural rate will inevitably lead to higher inflation. This is because, as unemployment falls, firms will have to compete for a smaller pool of available workers, leading to higher wages and, ultimately, higher prices.

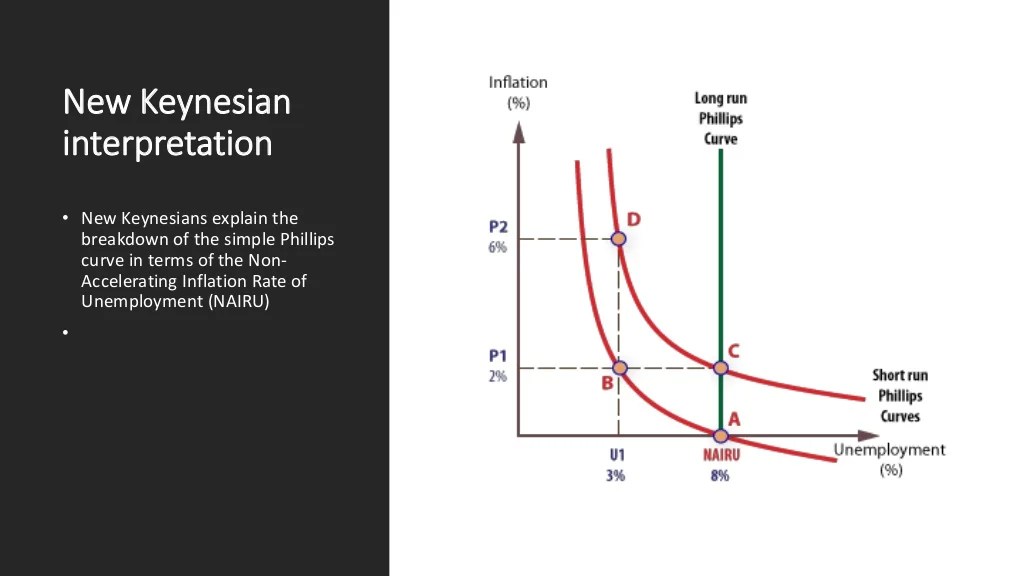

The New Keynesian Phillips Curve

The New Keynesian Phillips Curve (NKPC) is a more recent model that incorporates elements of both the traditional Phillips Curve and the Natural Rate Hypothesis. The NKPC suggests that the relationship between inflation and unemployment is not linear but instead depends on the level of economic slack in the labor market.

When the economy is operating below its potential, there is a negative relationship between inflation and unemployment. This is because firms have an incentive to hire more workers to meet demand, leading to lower unemployment and higher wages. However, as the economy approaches full employment, the relationship becomes more positive, as firms face increasing costs of hiring and are less willing to raise wages.

The Vertical Phillips Curve

The Vertical Phillips Curve is a model that assumes that there is no trade-off between inflation and unemployment. This model suggests that the natural rate of unemployment is the only sustainable level of unemployment, and any attempts to reduce unemployment below this level will result in higher inflation.

The Vertical Phillips Curve is often used to justify tight monetary policies that aim to keep inflation low, even at the cost of higher unemployment.

Policy Implications of the Phillips Curve

The Phillips curve has important implications for economic policy. By understanding the relationship between inflation and unemployment, policymakers can make informed decisions about how to manage the economy.One of the most important trade-offs involved in using the Phillips curve for policymaking is the trade-off between inflation and unemployment.

In the short run, policymakers can reduce unemployment by increasing inflation. However, in the long run, this trade-off is not sustainable. As inflation increases, it becomes more difficult to reduce unemployment further.Another important trade-off involved in using the Phillips curve for policymaking is the trade-off between economic growth and inflation.

In the short run, policymakers can stimulate economic growth by increasing inflation. However, in the long run, this trade-off is not sustainable. As inflation increases, it becomes more difficult to sustain economic growth.Policymakers must carefully consider the trade-offs involved in using the Phillips curve for policymaking.

There is no easy way to achieve both low inflation and low unemployment. Policymakers must make difficult choices about how to balance these two goals.

Essential FAQs

What is the Phillips curve?

The Phillips curve is an economic model that describes the inverse relationship between inflation and unemployment.

What are the assumptions of the Phillips curve?

The Phillips curve assumes that inflation is primarily driven by excess demand in the labor market and that unemployment is primarily driven by excess supply in the labor market.

What are the criticisms of the Phillips curve?

The Phillips curve has been criticized for its oversimplification of the relationship between inflation and unemployment and for its failure to predict the stagflation of the 1970s.